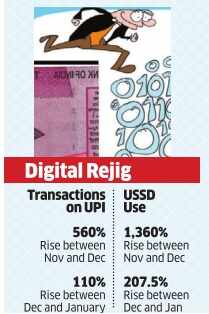

Data released by the Reserve Bank of India shows that the number of transactions on Unified Payments Interface (UPI) jumped 560% between December and November last year and 110% between January and December.

Data released by the Reserve Bank of India shows that the number of transactions on Unified Payments Interface (UPI) jumped 560% between December and November last year and 110% between January and December.On the other hand, Unstructured Supplementary Service Data (USSD) shot up 1,360% between November and December and buoyed the January to December jump to 207.5%.

Transactions on UPI jumped to 4.2 million for January against 0.3 million in November while that on USSD leapfrogged to 3,14,000 in January from 7,000 in November.

“In percentage terms, the number is very high since the base is very low, but there was a huge hype created around BHIM payments application which uses UPI railroads and USSD for feature phones which reflects in the numbers shown by RBI,“ said Bhavik Hathi, MD at consultancy firm Alvarez&Marsal.

Hathi said the jump in USSD was because a major part of India still uses feature phones. National Payments Corporation of India, which runs UPI and USSD, said prize money being announced by the government for people doing maximum transactions digitally could be a major reason for this jump.

Hathi said the jump in USSD was because a major part of India still uses feature phones. National Payments Corporation of India, which runs UPI and USSD, said prize money being announced by the government for people doing maximum transactions digitally could be a major reason for this jump.Card transactions through point of sales terminals showed an 18% decline for January compared to December. Bankers say the fall could be because of sluggish demand in January.

“We have observed a little slowdown in January, but that number is not very huge,“ said Arundhati Bhattacharya, chairman, State Bank of India. “I believe the digital payments momentum will continue. For SBIPay, our UPI application, we have received two lakh registrations and have reported around 11lakh transactions.“

While card payments showed sporadic growth, industry observers say lack of terminals in smaller towns and people's comfort with mobile phones will make mobile phone based payments to pick up.

“There is a psychological sense of security that people feel while paying through phones as there is no physical handing out of the device, which is not the case with cards, which Indians are always worried about,“ said Hathi.

0 comments:

Post a Comment