PayU India has scrapped its plans to launch a credit card. Instead, it will launch a digital consumer credit product, LazyPay, next week.

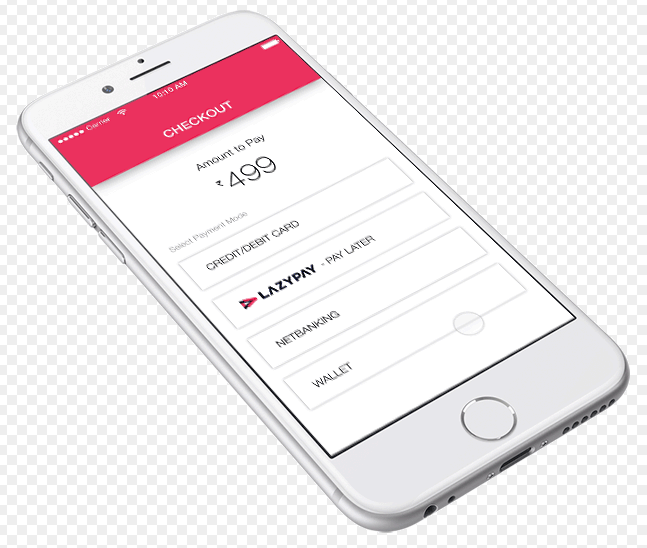

PayU India has scrapped its plans to launch a credit card. Instead, it will launch a digital consumer credit product, LazyPay, next week.A product developed by Citrus Pay, which PayU acquired last year for $130 million, LazyPay would give its users an option to pay later for their online purchases.

“We are now set to go live next week with 20 online merchants where consumers can use the option to pay later,"said Jitendra Gupta, managing director of PayU India.

He said the credit card product was shelved due to the unviable cost structures. The firm has laid off about 60 employees who were meant for call centre and collections operations for the credit card.

“Credit card payments have a success rate of 80-82%, with 20% drops happening due to infrastructure and network issues.Customer acquisition costs are also high,"said Gupta who founded Citrus Pay .

“But with LazyPay, it is a convenience product for anyone to pay later and the credit line can extend from Rs 3,000 and even up to Rs 2,000 to Rs 10,000, depending on the profile of the customer," he said. Gupta said the company has developed algorithms for dynamic, real-time underwriting based on 80-odd variables.

The credit option will be available to customers on 20 online merchant platforms including players in food delivery , grocery delivery and movie ticketing spaces. “We will add about 1,000 merchants in the next two months,"Gupta said.

He said the product has been designed as a deferral payment option and hence does not need a separate license or regulatory approval. The company is in initial stages of partnering with some banks, he said.

PayU India CEO Amrish Rau said the move to scrap the credit card product and launch LazyPay also meant reallocating some resources from the original project.

0 comments:

Post a Comment