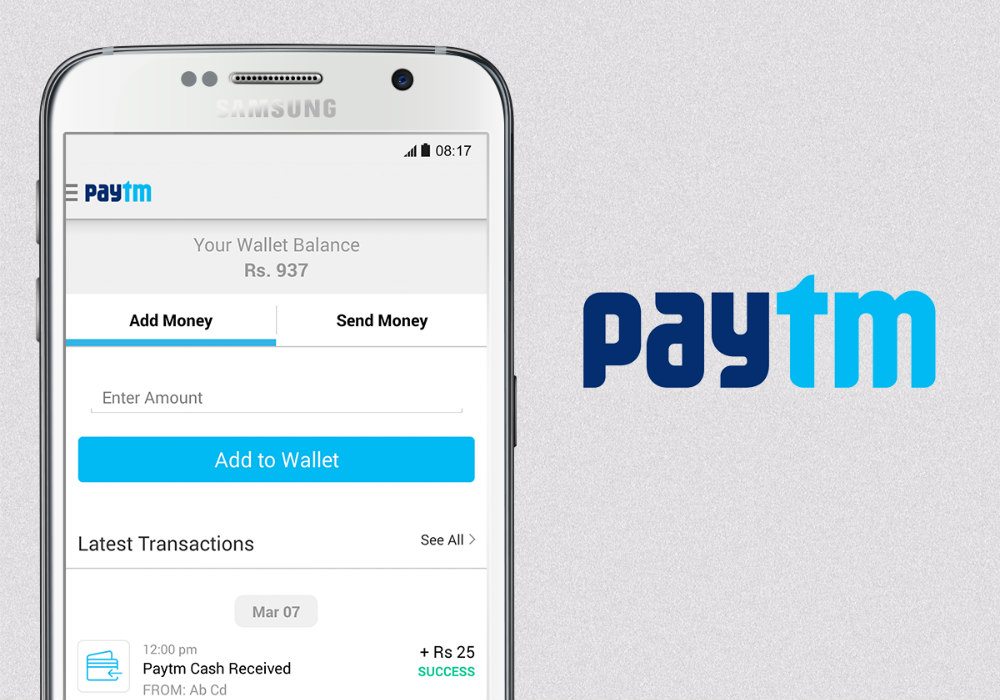

Digital wallet participant Paytm will now levy a 2% fee for adding money to Paytm wallet using credit cards. this is a end result of more than one users the use of Paytm to get free credit by using the use of credit score playing cards to top up their digital wallets and shifting the cash back to their financial institution money owed at zero transaction value.

Digital wallet participant Paytm will now levy a 2% fee for adding money to Paytm wallet using credit cards. this is a end result of more than one users the use of Paytm to get free credit by using the use of credit score playing cards to top up their digital wallets and shifting the cash back to their financial institution money owed at zero transaction value.The virtual fee pockets will, however, provide an equal amount of cashback for the use of credit card to feature money to the pockets. The value of including cash to the pockets thru other modes along with netbanking and debit playing cards remains non-chargeable.

In November, Paytm had added zero% platform charge centered at small merchants to accept payments to their wallet for the duration of the circulate to demonetise high fee currency notes.

The platform does now not charge any rate to switch back the quantity within the wallet to a person's financial institution account.

In a blog publish written on Wednesday, Paytm stated, "Paytm can pay hefty fees whilst you use your credit score card at card networks and issuing banks. If a user honestly provides money and takes it to the bank, we lose cash." the two% price may be relevant with impact from March 8, adding that the platform will make cash most effective if the wallet balance is used to pay for products and services on the Paytm ecosystem.

customers on a couple of social media web sites have additionally talked about that the pockets turned into being used to earn credit card points and get entry to loose credit score for gratis. traders processing credit score card transactions, in this example Paytm, pay a charge for interbank settlement of the price, known as service provider bargain rate which could be as high as three to four%. credit score card users transacting on the Paytm marketplace, booking tickets and paying software bills on the platform will now not be charged the said charge.

The platform has also introduced UPI enabled fee and immediate price provider (IMPS) for fast fund transfer among banks the use of mobile phones. those gateways will be to be had for buying, invoice payments, ticketing and filling Paytm pockets. The Alibaba-subsidized platform has over 2 hundred million wallet customers and plans to create a community of 1crore offline traders.

0 comments:

Post a Comment