Mobile wallet company MobiKwik has announced an investment of Rs 300 crore to expand its current base from 50 million to 150 million in 2017.

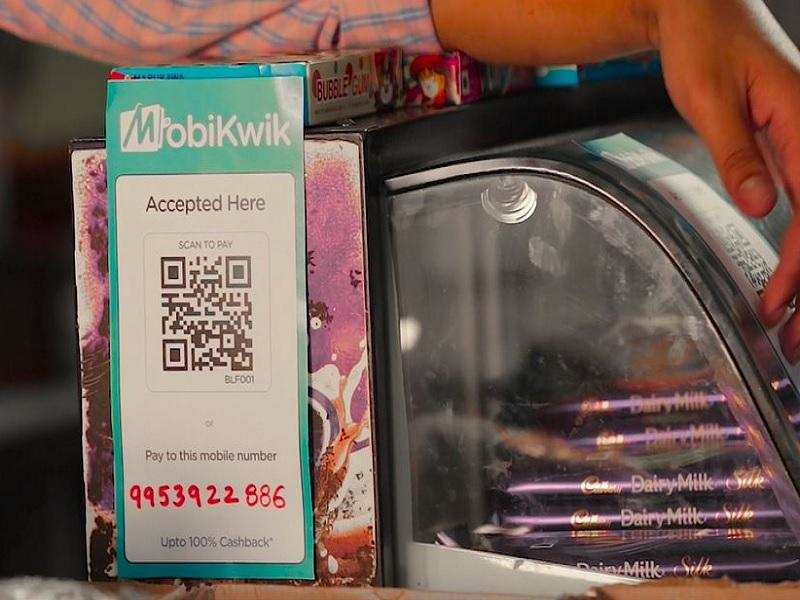

Mobile wallet company MobiKwik has announced an investment of Rs 300 crore to expand its current base from 50 million to 150 million in 2017.To support this expansion, MobiKwik is launching a loyalty initiative called 'Supercash' that allows users earn reward points at all MobiKwik merchants, including local mom and pop stores. These points can then be used by users to save money in the following transactions.

“We aim to increase the number of our users to 150 million by the end of this year, targeting $10 billion GMV. The investment of Rs 300 crores will be deployed in loyalty initiatives, expanding our reach & network, and launching other financial services such as loans & investments on our platform.” said MobiKwik co-founder Upasana Taku.

ET had reported in October that MobiKwik is entering the lending space to facilitate personal loans. The company had recently announced that it is setting up offices in 13 cities by the end of Q1 2017, including a Pune office last month. It currently has more than 1.4 million merchants on its network and hopes to grow the base to over 5 million by the end of this year.

MobiKwik recently received the Bharat Bill Payment License, with which the company will be powering payments for all utility and convenience bills across India. The company also launched a lighter version of its app to tackle poor data connectivity.

The Gurugram-based firm has so far raised over $80 million from marquee investors like Sequoia Capital, American Express, MediaTek, Net1, GMO Payment Gateway, Cisco Investments and Tree Line Asia.

0 comments:

Post a Comment